The world of exchange-traded funds (ETFs) has become increasingly popular among investors seeking to diversify their portfolios and capitalize on the growth of the tech industry. One such ETF that has garnered significant attention is the ProShares UltraPro QQQ ETF (TQQQ). In this article, we will delve into the details of TQQQ, exploring its price, quote, news, and analysis to provide investors with a comprehensive understanding of this investment opportunity.

What is ProShares UltraPro QQQ ETF (TQQQ)?

The ProShares UltraPro QQQ ETF (TQQQ) is a leveraged exchange-traded fund that tracks the Nasdaq-100 Index, which comprises the 100 largest and most actively traded non-financial stocks listed on the Nasdaq stock exchange. TQQQ aims to provide investors with 3x daily leveraged exposure to the Nasdaq-100 Index, making it an attractive option for those seeking to capitalize on the growth of the tech industry.

Price and Quote

The price of TQQQ can be volatile, given its leveraged nature. As of the latest quote, the ETF is trading at around $120 per share. However, it's essential to note that the price can fluctuate rapidly due to market conditions and the fund's leveraged exposure. Investors can check the current price and quote of TQQQ on financial websites such as Yahoo Finance or Google Finance.

News and Analysis

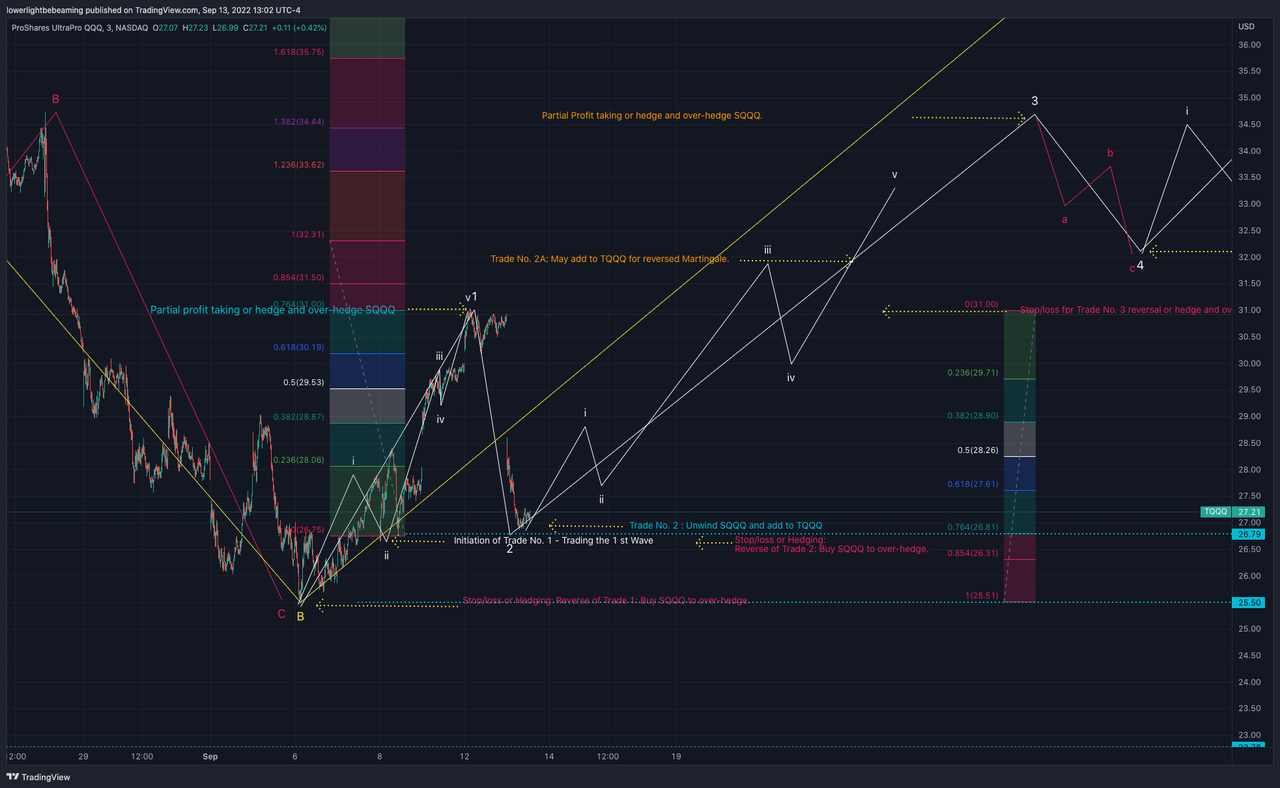

Recent news and analysis suggest that TQQQ has been performing well, driven by the strong growth of the tech industry. The ETF has been benefiting from the surge in popularity of tech stocks, such as Amazon, Apple, and Microsoft. However, it's crucial to keep in mind that the fund's leveraged nature means that it can be more volatile than traditional ETFs.

According to analysts, TQQQ is an excellent option for investors seeking to capitalize on the growth of the tech industry, but it's essential to approach with caution. The fund's high-risk, high-reward nature makes it more suitable for experienced investors who can stomach the potential volatility.

Investment Strategy

Investors considering TQQQ as part of their investment strategy should keep the following points in mind:

Leveraged exposure: TQQQ provides 3x daily leveraged exposure to the Nasdaq-100 Index, making it a high-risk, high-reward investment.

Volatility: The fund's price can be highly volatile due to its leveraged nature and the rapid fluctuations in the tech industry.

Diversification: TQQQ can be used as a tool for diversifying a portfolio, but it's essential to approach with caution and consider the overall risk tolerance.

The ProShares UltraPro QQQ ETF (TQQQ) is a powerful investment tool for those seeking to capitalize on the growth of the tech industry. With its 3x daily leveraged exposure to the Nasdaq-100 Index, TQQQ offers a high-risk, high-reward opportunity for investors. However, it's crucial to approach with caution and consider the fund's volatility and leveraged nature. By understanding the price, quote, news, and analysis of TQQQ, investors can make informed decisions and unlock the power of tech in their investment portfolios.

Learn more about ProShares UltraPro QQQ ETF (TQQQ)

Note: This article is for informational purposes only and should not be considered as investment advice. It's essential to consult with a financial advisor before making any investment decisions.

![[TQQQ] 2월 개인소비지출 물가지수. 예측 5.1, 근원 4.7 LIVE - YouTube](https://i.ytimg.com/vi/hkNTryILEC0/maxresdefault_live.jpg)